The bond was priced at a re-offer yield of 0.236%, equating to a spread of +30 bps over interpolated OATs. The transaction received an outstanding support from the international investor community with an orderbook closing in excess of EUR 3.1 billion of interests. Joint lead managers were Crédit Agricole CIB, HSBC and Société Générale.

“Today’s solid outcome confirms Île-de-France Mobilités’s strong access to the capital markets despite overall challenging times. Both the record size orderbook and the participation of new investors are a testimony of investors’ good understanding of Île-de-France funding model.”

This new source of finance should contribute to the ambitious investment programme of EUR 15.1 billion undertaken by the authority responsible for the organisation of public transport and sustainable mobility of the Paris region over the 2020-2025 period. These massive investments will enable it to respond to the day-to-day needs of the population of Île-de-France for faster, safer, more comfortable, more environmentally friendly, more accessible and more modern public transport.

Transaction Details:

On Friday 30th October, IDFM announced to the markets a mandate for a new EUR benchmark at 15-year and two Global Investor Calls to take place on Thursday 5th November for French and international investors, with the aim to provide an update on the credit, the impact of the Covid-19 crisis and the French State financial support.On the back of supportive market environment on Monday 9th November, orderbooks were officially opened at 9h20 CET for a EUR 500m no grow transaction with a price guidance set at interpolated OATs + 34 bps area. Investors’ interests were strong and immediate as when the first update was released at 10h40 CET, the deal was already 4x oversubscribed. This enabled the issuer to revise the guidance tighter at interp. OATs + 32 area. At 11h08 CET, interests exceeded EUR 2.4 billion (excluding JLMs) and the reoffer spread was therefore fixed at interp. OATs+ 30 bps, providing no new issue premium.

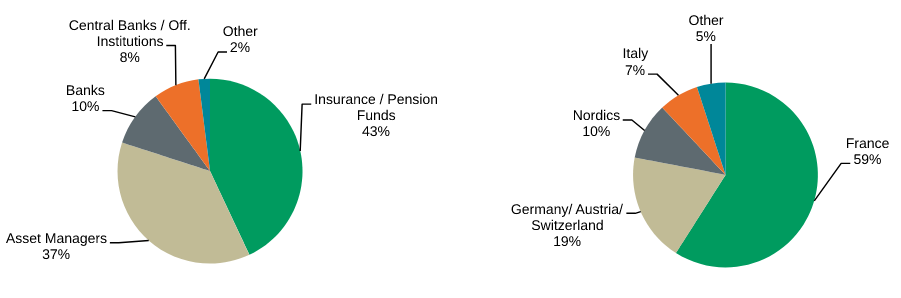

There was solid demand from a broad range of top quality accounts with books closing in excess of EUR 3.1 billion and around 115 investors involved. The transaction was characterized by a well-balanced distribution, both by investor type and by geography.

Composition of demand for the issue by allocation breakdown:

| By Investor type: | By Geography: |

| Insurance / Pension Fund 43% | France 59% |

| Asset Managers 37% | Germany/Austria/Switzerland 19% |

| Banks 10% | Nordics 10% |

| Central Banks / Official Institutions 8% | Italy 7% |

| Other 2% | Other 5% |

Summary of the Terms and Conditions for the new Bond Issue:

| Issue Amount | EUR 500 million |

| Pricing Date | 9 November 2020 |

| Payment Date | 16 November 2020 |

| Maturity Date | 16 November 2035 |

| Re-offer Price | 99.47% |

| Re-offer Yield | 0.236% |

| Annual Coupon | 0.200% |

| Re-offer Spread | Interpolated OATs + 30 bps |

| Listing | Euronext Paris |

| Joint Lead Managers | Crédit Agricole CIB, HSBC, Société Générale |